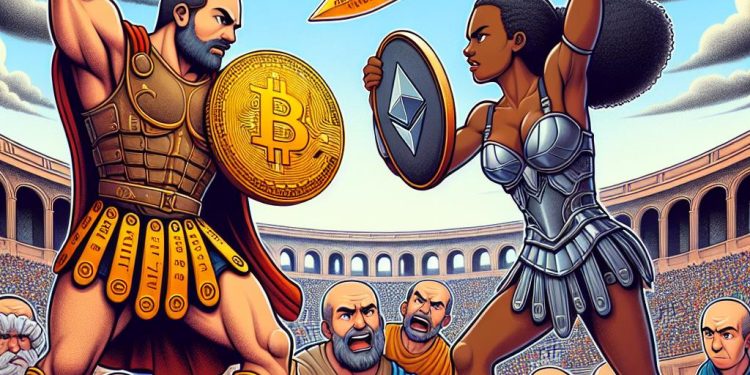

The debate between Bitcoin and Ethereum investors is more intense than ever, as both groups present compelling arguments regarding performance, future upgrades, and long-term market dominance. If you’ve been keeping an eye on the cryptocurrency space, you know it’s a lively ecosystem full of promise and unpredictability. Both Bitcoin and Ethereum are giants in their own right, but which one truly deserves the crown? Lately, many investors are feeling torn. Torn not just between coins, but between the potential of blockchain technologies that underpin them. The question on everyone’s mind: which will reign supreme in the future?

Understanding the Core Differences

Bitcoin, the poster child of cryptocurrencies, was designed primarily as an alternative currency—a digital gold if you will. It’s praised for its security, decentralization, and fixed supply of 21 million coins. Ethereum, however, brings something different to the table: it's a decentralized platform that enables smart contracts and decentralized applications (DApps). This flexibility and functionality make Ethereum a favorite among developers. According to a recent analysis, Ethereum’s adaptability could propel it past Bitcoin in certain metrics.

Bitcoin: The Digital Gold Standard

- Stability and Security: Bitcoin’s blockchain is renowned for its robust security. It’s been tried and tested over more than a decade without any successful breaches. I remember when back in 2017, Bitcoin was skyrocketing, and everyone was talking about its potential to replace traditional fiat currencies. Where do you stand on Bitcoin as a currency?

- Limited Supply: The capped supply of Bitcoin creates a scarcity that appeals to investors looking for long-term value preservation. This isn't just a financial tool; it's potentially an inflation hedge akin to gold.

Ethereum: The Platform for Innovation

- Smart Contract Capability: Ethereum is more like a decentralized world computer. Its ability to create self-executing contracts opens a plethora of possibilities for innovation.

- Upcoming Upgrades: Ethereum is not standing still; it’s gearing up for major upgrades to Ethereum 2.0, which aims to enhance scalability, security, and sustainability. These improvements might shift the balance of power in the crypto world. Ever wonder how far Ethereum could go? Looking at these potential upgrades, it seems the sky might just be the limit.

- Developer Favorites: With the vast majority of DApps being built on Ethereum, its network effect is significant. According to reports, developer interest is one of the biggest drivers of Ethereum’s growth.

The Bigger Picture

Amidst the back-and-forth, it's essential to consider broader market factors. For instance, Federal Reserve policies have been known to disrupt crypto markets significantly. Furthermore, global political dynamics, like concerns around AI exports, might play a role in steering the cryptocurrency narrative.

Conclusion: The Verdict

In summary, whether you're more inclined towards Bitcoin’s simplicity and security or Ethereum’s potential for innovation, it's clear both have significant roles to play in the future of finance. Who will ultimately emerge as the leader? That remains to be seen, but one thing is for sure: the journey will be interesting to watch. Where do you see yourself investing? Have you made up your mind, or are you still deliberating? The battlefield for cryptocurrency supremacy is just heating up, and every new development could tilt the scales.