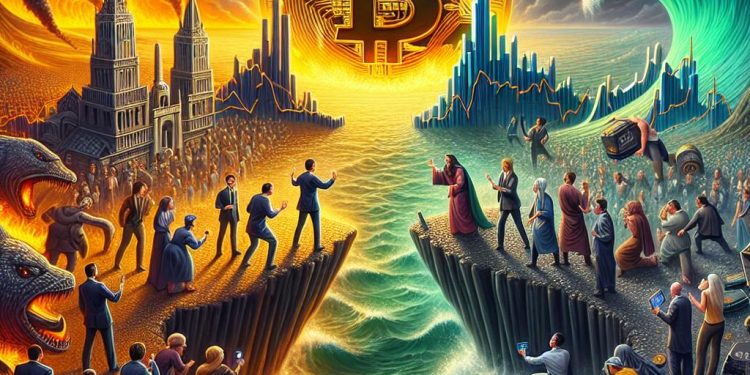

In recent years, the financial landscape has been dominated by a fierce debate: the stability of traditional investments like NASDAQ stocks versus the volatility and allure of cryptocurrencies, particularly Bitcoin. As the tech sector continues to innovate, so does the financial realm, with investors constantly reassessing risk and reward. This ongoing dialogue raises a pressing question—is the unpredictable nature of cryptocurrencies more appealing than the perceived bubble risks surrounding tech stocks?

Understanding Volatility in Investments

Both Bitcoin and NASDAQ have faced their share of challenges. Cryptocurrencies are notorious for their volatility; prices can soar one moment and plummet the next. For instance, Bitcoin has witnessed wild swings which makes it both a potential goldmine and a risky endeavor. On the other hand, tech stocks within NASDAQ have raised alarms about possible bubbles, especially with AI-driven market valuations (see NASDAQ Stock Rally Sparks Heated Investor Debate).

Key Considerations:

- Volatility in Bitcoin: While it’s true that many have multiplied their investments overnight, others have faced significant losses. This unpredictability leaves many asking, "Is it worth the risk?"

- Tech Bubble Concerns: NASDAQ’s ties to the tech industry bring inherent risks. The rapid pace of technological advancements and AI developments fuel concerns about sustainability and potential downturns.

Both avenues are undeniably enticing, but they also pose unique challenges. A glimpse into Ethereum’s erratic price changes showcases similar concerns in the broader crypto space.

Safe-Haven Investments: A Myth or Reality?

During economic uncertainty, investors race to secure their wealth in 'safe-haven' assets. Gold has traditionally held this status, but some now argue that Bitcoin could assume this role. Its decentralized nature theoretically insulates it from government or economic turmoil. However, this hypothesis doesn't always hold as market behaviors can be remarkably unpredictable.

Moreover, NASDAQ offers tech stocks that, while volatile, have historically rebounded post-recession, showcasing long-term viability. The debate remains whether tech stocks can still offer security compared to other investments or if we should demand action to redefine what 'safe' means in modern finance. For more insights into economic stability, check out the debates around Fed's interest rate policies.

Personal Experiences and Opinions

I had a similar experience once when I delved into this chaotic world of investments to secure my future. At first, I thought diversifying my portfolio with a mix of tech stocks and some Bitcoin would guarantee stability. Nonetheless, I quickly learned that every investment carries a degree of unpredictability. Have you ever felt the thrill of an investment paying off just to see it flip overnight? What strategies have you employed to balance your portfolio?

In wrapping up, investors face a complex array of choices today, each with their market intricacies and risks. Whether you lean towards Bitcoin's high stakes or NASDAQ’s perceived stability, awareness and informed choices remain critical. As the saying goes, "Fortune favors the brave," but wisdom might just be the truest path to prosperity in this volatile game of numbers.